Investment Summary

Target Properties

TECHNOLOGY SPACES

Given the highly digitized nature of modern commerce, most companies require some degree of data storage that requires specific facilities to house the storage equipment, run IT systems, and facilitate cloud storage and computing, including climate control and security protocols.

INDUSTRIAL SPACES

Distribution warehouses function as critical hubs in logistics networks. The space must allow companies to effectively serve their customer base and add efficiencies to the overall process through automated technologies, sufficient dock space, and proximity to freeways, railways, or airports if needed.

The CRE Income Fund is a commercial real estate fund designed to generate long-term capital appreciation and a 10% annual yield.

Why Invest in Commercial Real Estate?

Hedge Against Inflation

Hedge against Inflation and rising interest rates by targeting assets with 10-15+ year leases and annual rental escalations.

Lease to Investment-Grade Tenants

Lease to investment-grade credit tenants to mitigate default risk throughout the lease term.

Tax Efficiency

Real estate investments are structured in a tax-efficient manner, allowing investors to reduce taxable income through the use of depreciation.

Flexibility

Real estate investments can be nimble and flexible in their investment strategy, giving them the freedom to pursue profitable deals where they’re available.

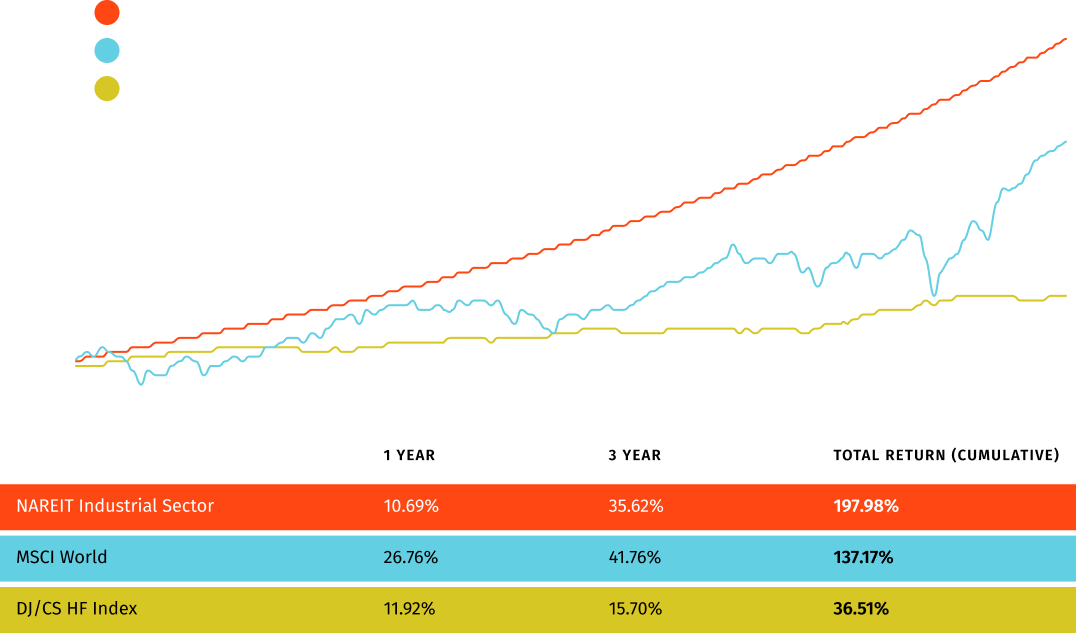

Historical Growth of the Industrial Sector

Higher than the MSCI

Greater than the DJ / CS

Download Offering

The confidential information in the CRE Investment Summary is only available to accredited investors and can be found by requesting additional information or a discussion with a CRE Income Fund representative.